There are lots of websites comparing home insurance rates but few explain why costs keep going up. There are so many major events happening around and to us, it's hard to understand how these are causing homeowner insurance costs to skyrocket. This article explains the insurance company costs that are driving up rates, in the same way that higher fuel costs are impacting the cost of air travel.

This article reviews what homeowners learned following the Marshall Fire outside Denver, Colorado. The fire destroyed more than 1,000 homes with an estimated value exceeding a half billion dollars. But it's the insurance story you need to understand, from news reports about Insurance Won't Cover Damage Wreaked by Colorado Wildfire.

Homeowners who thought their insurance covered 100% of the cost to rebuild their homes, are being told they are underinsured. In another article, homeowners share their story because they can't rebuild their home. They're underinsured by $600,ooo so they've filed a complaint with the state insurance department but … their quandary is how long should they wait to start rebuilding?

Fortunately Marshall Fire homeowners because of their numbers, are getting lots of help from the state. Most homeowners have to fight their insurance company on their own and it's painful. That's why I created a website, HomeInsureClaims.com, dedicated to helping homeowners fight to get what they deserve after suffering a catastrophic home event.

Table of contents

Note: In Florida, skyrocketing home insurance rates are also due to excessive lawsuits resulting from state laws, roofing companies and insurance companies that serve lawyers more than anyone else (read: Florida’s Homeowner Insurance Crisis to learn more).

Building Material Costs Affect Home Insurance Rates

We're all learning about supply chain problems, from a lack of toilet paper, new cars and cream cheese. The cost of lumber climbed steadily in 2020 as construction was considered essential (hospitals, long-term care facilities, public works construction and housing).

But the pandemic caused supply chain disruptions for everything housing construction depends on from lumber to roofing shingles, windows, appliances and more. When demand for materials exceeds supply, prices go up and thus today's inflation has had a significant impact on home building costs, as well as house prices. These shortages have continued into 2022, and no one knows when prices will stabilize.

Overnight, the insurance coverage you have for your house might not be enough … as most homeowners haven't learned to identify all the coverage caps that insurance companies have been adding to our policies. My initiation into this scary predicament came with my flooded house. That's the worst time to learn you have a mold cap … so you don't want to make this mistake!

Unfortunately few homeowners read their insurance policy until disaster hits and that's too late. It's time to learn what your homeowner insurance covers or doesn't. Why? The Center for Insurance Policy and Research, looking at Extreme Weather and Property Insurance, found that 56% of survey respondents thought their standard homeowner policy covers floods. In reality, you need to buy separate flood insurance but only 4% of respondents actually had had done this, leaving them at risk with paid flood losses averaging more than $60,000 per claim.

How Construction Labor Costs Factor into Insurance Costs

Along with delays in building materials, labor shortages remain following the pandemic. Contractors relocated and/or changed occupations to continue employment as builders adjusted their schedules to match available supplies. This added to the existing and significant backlog in home construction which remains from the housing crash.

With fewer houses for sale, the demand for new homes and remodeling projects has driven building costs even higher. That probably doesn't mean much to you … until you have a home emergency or major construction project that has to compete in this environment. That's the situation faced by homeowners affected by the Marshall Fire. They suddenly find themselves in a situation where they have to compete with existing constraints in the house construction industry, in a small concentrated area that is limited in where it can tap the labor pool.

That's why insurance claims for weather events like hurricanes or wildfires find much higher labor costs and to a lesser degree, materials costs, when responding to temporary spikes in local rebuilding costs.

Why the Cost of Personal Belongings Increases The Cost of Insurance

Sticker shock is everywhere today. Car prices, both new and used, have jumped due to supply chain problems. House prices are appreciating at double digits because demand far exceeds supply. Inflation in the US hit a 39 year high of 7% in January, 2022.

Supply chain problems mean the cost of some goods is more than double this figure. Does it make sense these skyrocketing costs will affect homeowner insurance claims? With the cost of living room, kitchen and dining room furniture increasing by about 14% nationally in 2021, insurance companies will have higher replacement costs so this is one more factor driving up home insurance rates.

Like insurance coverage for your home, you also don't want to accept the default coverage for personal property.. Here are a few tips to consider when reviewing your policy:

- Make sure you have enough coverage to replace items damaged or destroyed. Never accept “actual cash value” coverage which only reimburses you for the depreciated value. It's not just the dollars involved, it's also the emotional stress of calculating and fighting the insurance company about depreciation.

- Create a home inventory covering everything in your home. Start with video of each room and it's contents. Then list items (furniture and accessories, clothing, artwork and supplies) in a spreadsheet, ideally with your best guesstimate of replacement value (you'll have to update when you file a claim but this will save you time).

- Use your estimate to verify that your policy is adequate, with the possibility you'll discover more coverage is needed. Riders are typical for jewelry, antiques, electronics and more.

According to ValuePenguin “Typically personal property is insured for 20% to 50% of the coverage limits of your home. A typical policy may have $250,000 to cover the home structure and $100,000 of personal property protection which would be 40% of the $250,000.” When my house flooded, I had 50%, full replacement coverage and it was close because the entire house (2200 sq ft) had four to 6 inches of water.

How Climate Changes are Driving Up Home Insurance Rates

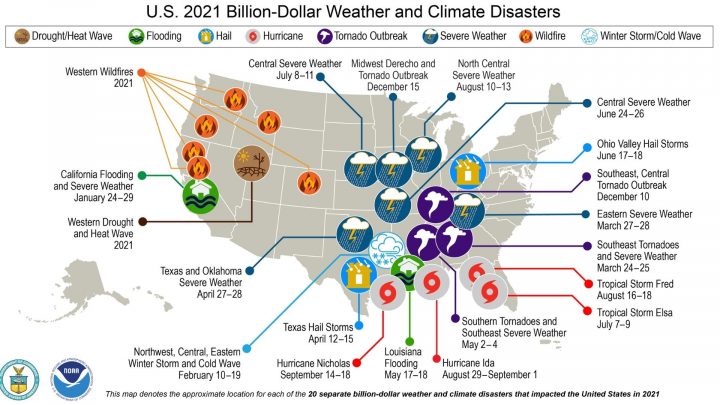

For years, most people have denied that global climate changes are happening. There's now enough evidence to prove that the number of severe weather events is increasing. In fact 2021 set a record for 20 separate billion dollar weather and climate related disasters in the US.

The frequency and billion dollar cost of so many weather events is now accepted in part, they're due to global climate changes. They're obviously driving homeowner insurance costs higher in order for insurance companies to remain in business!

Leave a Reply