When you buy a house you focus on the mortgage, property taxes and homeowner insurance. These costs won't tell you the true cost of home ownership. Imagine how you would handle a $500 water bill or an electric bill exceeding $700. It's time to track homeowner expenses starting now!

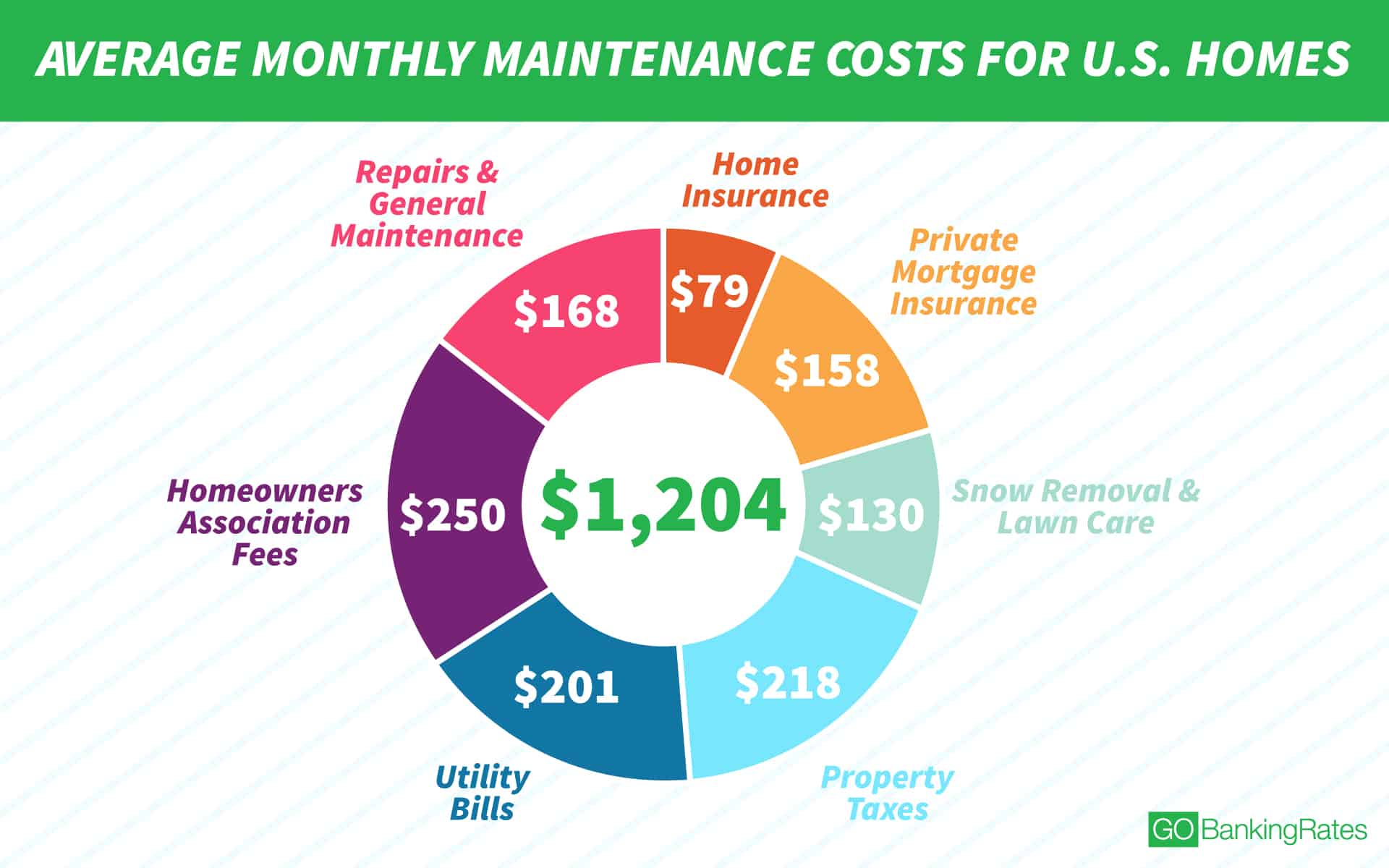

The problem is looking at individual expenses in a vacuum. A more realistic view of what you'll spend is illustrated by the chart above from GoBankingRates.com. Using the average American home cost of $360,000,

- With 20% down, a mortgage at 4% is $1,375. Subtract PMI of $158 = $1,046 for total monthly cost of $2,421.

- With 10% down (requires PMI), a mortgage at 4% now costs $1,547. Add $1,204 and month costs go up to $2,751.

Track Homeowner Expenses: Mortgage & Escrow Account

The tendency today is to set up automatic payments and forget about these expenses. While I've done this in the past, I'm now using online bill pay. There's an autopay feature for fixed expenses along with eBills for most expenses except county bills for water. This allows me to see all my monthly expenses every month, making it easier to track homeowner expenses.

- Track your mortgage payments. This will keep it top of mind so you'll pay more attention to changes in mortgage rates which change day-to-day.

- Monitor interest rates. Generally, a 1 point drop is when refinancing makes sense if you're not planning to move soon. Your lender may offer alerts to rate changes or you can sign up for alerts with a site like BankRate.com. Here's an example of how much you can save monthly …

- $250,000 mortgage at 4.25% costs $1,230/mo

- $250,000 mortgage at 3.25% costs $1,088/mo for a savings of $142/mo or $1,704/yr.

- With refinancing costs of $2,200, you’ll recover those costs in 16 months.

- Shop for the best mortgage rate. I've found the best rates through Costco's mortgage services. The cost of a membership is outweighed by the cap they've negotiated for closing costs.

- Turn a 30 year mortgage into a 15 year mortgage. For years I've stuck with 30 year mortgages for flexibility. It's easy to increase monthly mortgage payments that get applied to the principal. The result is you can pay off your loan in 20, 15 or even 10 years depending on how much extra you pay.

- Stop paying PMI once you’ve got 20 to 22% equity. Lenders might not volunteer to give up this income so you'll have to monitor this yourself, and request this change. Be careful too as I found one lender who said “we don't charge PMI” which didn't sound right. My interpretation (no proof) is you'll pay PMI for the life of the loan.

- Get competitive quotes for homeowner insurance every few years. Insurance companies raise rates annually and make increases small enough so you don't notice. After 5 or 10 years, you're paying significantly more than your neighbors which my web team (Wendy and Mona) discovered when we reviewed my worksheet to track homeowner expenses.

- Read your homeowner policy before you buy it! That's because I missed two monetary caps buried in the details and discovered them after my house flooded, which is too late. More to follow so for now, I found a $3,000 cap on emergency mitigation which doesn't come close to covering an event affecting your entire house. There's also protection for Florida insurance companies, allowing them to cap mold coverage at $10,000 which doesn't come close to actual costs.

- Review other homeowner insurance you might need. Flood insurance is required for those living in a high-risk area and some places need extra coverage for wind and hail.

- Home warranties are not insurance policies, so before you get fooled into buying this product … do your homework (read: What is a Home Warranty).

Track Homeowner Expenses for Utilities

Homeowners have more utility bills than renters. You might be used to an electric bill, phone, Internet and one or more cable plans for content. Once you buy a house, you'll start paying for water, trash pickup and maybe a security monitoring service. Here are ideas for saving money on one or more of these bills.

- Ask your electric company how you can save money. For example, Arizona Salt River Pprojects’s electricity “off peak” plan compensates consumers with lower rates when there's less demand.

- Consider solar if there are cost effective options available where you live. Monitor local news as programs vary by state. Be sure to talk to several homeowners to get the real story before signing up.

- Monitor electric and water bills for unexplained peaks. This can indicate you have a water leak or a malfunctioning thermostat … and I've had both over the years. My flooded house caused peaks too:

- Electric bill jumped to more than $800 due to 35 fans and dehumidifers running 7 x 24 for more than two weeks (normal bill around $100/mo in Florida).

- Water bill for the fresh water supply line (and/or reclaimed water leaks outside) that flowed for no more than 32 hours was $225 instead of the normal $75/mo.

- Lock in your heating oil price during the summer. This helps oil companies to negotiate better rates and you won't have to worry about price fluctuations through the winter heating season.

- Preventive maintenance will help your HVAC and hot water systems work more efficiently. You'll benefit with lower utility bills and extend the life of your home’s critical systems.

- Use new technology to save money. For example, smart locks can send alerts to your phone in place of ADT’s monthly security bill.

Track Homeowner Services for Content & More

It's hard to imagine what life was like before smart phones. Even more than the Internet or video games, phones today are delivering more content than we could have imagined. Similar to low television prices and high cable bills, future content costs will drive your budget higher and higher (read: Net Neutrality & Why It Matters).

- Find a digital bundle that fits your needs without paying for things you won’t use. The cable companies are bundling a land line with cable and the Internet, but do you really need/want a landline anymore?

- Use a family plan when it saves money. You don’t have to be a legal family or live together for family cell plans. My plan includes my former husband, my sister and my grown sons.

- Content isn’t my specialty and huge changes are coming. You’ll save by reviewing/renegotiating subscriptions at least once a year.

Homeowner Time Saving Services

We're all busy and don't have time to handle all the weekly chores around the house. You're number one priority is to make sure things get done on the recommended schedule. Pick one you'll enjoy doing and find help for all the others.

- Research what’s critical like pest control. Get recommendations from neighbors as to what's needed along with recommendations on reliable contractors. Don’t skip getting these tasks done as ignoring them will cost more in repairs.

- Partner with neighbors to negotiate lower rates for services like lawn care, pool care, snow blowing, etc. It works because they only have to drive to one location for multiple customers.

Track Homeowner Expenses for Maintenance, Repairs & Upgrades

Car maintenance is easy because there's only one place to take your car and they give you a schedule for required maintenance. With a house you need a team of home contractors – a plumber, electrician, HVAC company and a handyman. The challenge is who's in charge … and that person is you!

Once you've picked your strategy, it's time to build a budget for home maintenance, repairs and upgrades (get home maintenance checklists here). How much you set aside will depend on how much work you'll do yourself and where you live. Here's a framework to get started:

- 1% of home purchase price for houses less than 5 years old.

- 2% if your house is between 5 and 15 years old.

- 3% for houses 16 to 25 years old.

- 4% of home price for houses that are 25 years or older.

Leave a Reply