As a homeowner, the best escrow decision you can make is to refuse to use an escrow account when closing on a new mortgage. This is the only point in the process where you're in control. Once you've allowed an escrow account to be setup, you're at the mercy of the mortgage servicer. They control the rules and make it difficult for you to learn how to remove the escrow account from your mortgage.

Problems with My Escrow Account

For more than 15 years I paid my property taxes and insurance directly. When I moved to Tokyo, it was time to setup an escrow account. I wasn't comfortable managing things long distance without email and online access to my mortgage … things we take for granted today. So I continued using escrow accounts for years but that's about to end, which is why I'm focused on removing my escrow account from mortgage.

Research for this article has identified even more problems than I was aware of. My thanks to the Consumer Compliance Outlook website for their article, Escrow Accounting Rules: Are You in Compliance? Here are just the problems I've had with my escrow account in just two years … so likely you're also experiencing problems.

Initial Funding of Escrow Account Wrong

My current mortgage was a refi done one year after I closed on my new home. This was planned to capture the upgrades I did right after closing (read: Top 3 Home Renovations Before Moving into a New House), remove PMI and with luck, a lower interest rate.

During the refi process, I corrected the estimated property taxes to reflect what my neighbors were paying. Unfortunately the lender's automated process ignored my corrections and reset escrow funding using the artificially low taxes for a new house on unimproved land (no house, no Certificate of Occupancy or CO). So here's what mortgage servicer Dovenmuehle did wrong (quotes from ConsumerComplianceOutlook.org):

- They failed to “… conduct an escrow account analysis before establishing an escrow account.” If they'd done their due diligence and “… delivered an initial escrow account statement to the borrower), I would have pointed out the mistake if they didn't catch … but no, they didn't do their job.

- As a programmer with 29 years at IBM, I was glad to see confirmation by an authoritative website that “… Errors can result from a combination of over reliance on automated systems to perform the required calculations and staff not sufficiently versed in the rules.” It feels like staff isn't allowed to make decisions which was the case with my problem.

Duplicate Payment for New Insurance Policy

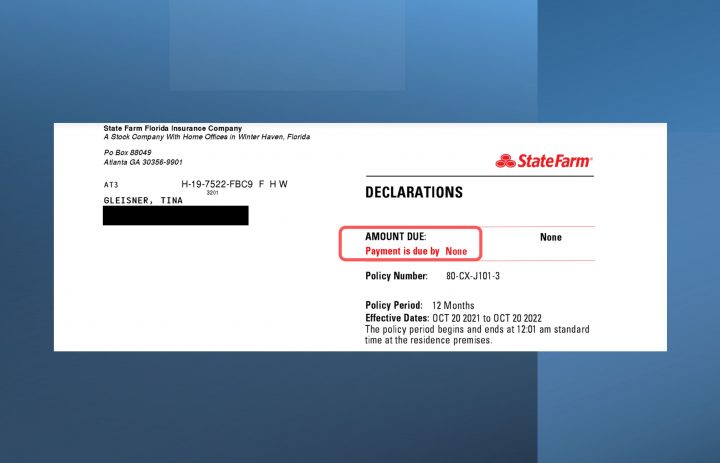

As I understand escrow accounts, I knew there wouldn't be enough money in the account to cover my new homeowner policy … so I paid for it (above). This really meant that I was out of pocket for twice the money because 50% of the insurance premium was in escrow, and it would take time to get a refund from my old insurance company, for the uused six months coverage.

Unfortunately, Dovenmuehle, my mortgage servicer, paid the new insurance company because … I guess reading paperwork isn't in their job description? This was enough to know it was time to learn how to remove the escrow account from my mortgage … and specifically asked to remove insurance from the escrow account!

Arbitrary Escrow Analysis Roadblocks

When I removed insurance from my escrow account in November, I left the property taxes alone because they were due to be paid in the next 14 days. In December I called to remove property taxes from escrow and lower my monthly mortgage payment to cover just principal and interest.

Customer service at Dovenmuehle told me I had to wait for the escrow analysis which was due late December. When it didn't arrive, I called again … and working with a supervisore, we found the analysis. The format was difficult to read and surprisingly, they didn't offer an option to pay the shortage in a lump sum versus spreading it across 12 monthly payments.

We found the shortage of $428.35 so I told customer service I would add this to my January payment and reduce my monthly mortgage payments to principal and interest beginning in February. Surprisingly, the mortgage statement shows the account, shortage or overage … the same $428.35, so we never needed the escrow analysis.

Escrow Madness as Computers Rule?

The saga continued into February when I discovered:

- Wondering how to remove an escrow account from your mortgage? There's no form to submit like canceling my old insurance required … and Dovenmuehle's people forgot to submit a request to cancel escrow!

- Mortgage processor acting like the corporate bully it is, refused to process my February mortgage payment because it didn't include the escrow amount they wanted. You can see this above, where the dashboard implies I never paid my February payment … except I have proof that my check was deposited by them, by the 2/15 due date.

- Adding insult to injury, Dovenmuehle slapped a late payment penalty on my escrow account. Fortunately I've developed a great working relationship with my loan officer and he got this removed … as I wasn't going to pay it.

On February 28th, I asked my loan office for help resolving the issues preventing me from closing my escrow account. His team looked into the situation and sadly said I needed to pay the outstanding escrow money … even though it would then be returned to me?

What am I supposed to do now?

The March statements (2 of them) indicate the escrow account is closed, the late payment penalty has been reversed and I check has been issued to refund the money remaining in the escrow account. The only open item appears to be processing of the February payment for principal and interest … which is still showing as overdue?

Guidelines to Remove Escrow Account from Your Mortgage

While doing research for this article, I did find lots of advice on how to remove an existing escrow account. Here are the most important suggestions I can offer:

- Talk to your mortgage servicer and ask for documentation on their rules to close your escrow account, as every servicer does things a little different.

- Send a formal, written request to cancel your account … which unfortunately, I didn't do so learn from my mistake.

- Make sure your loan type doesn't require an escrow account. FHA and USDA do.

- Verify you meet all loan servicer requirements. Typically these include 20% equity (VA loans need 10% equity), loans open for at least one year and no late payments.

- Make sure you don't have any taxes or insurance payments due within 30 to 60 days. That's why I stopped insurance first but waited for property taxes to be paid before cancelling escrowing of taxes.

Setting Up a Simple Escrow Account You Can Manage

Managing homeowner expenses is a bit challenging … but managing what goes into an escrow account is really simple. It's the fluctuating electric and water bills that are driving me crazy so in comparison, this can be done in about 10 minutes.

- Open a new, free checking account at your bank (I prefer credit unions).

- Calculate annual costs for property taxes ($3,300), homeowner insurance ($1,200) and I've included my HOA fees ($3,300) which are paid quarterly.

- Divide annual costs by 12 months, which for me is $650/mo.

- Setup an automatic monthly transfers from your regular checking account to what I call my “escrow” account.

- For fixed expenses like HOA fees, set up automatic payments. When I did this, all I had to do is change the existing payment to come out of the new escrow account.

- Setup reminders on your calendar for variable expenses like property taxes and homeowners insurance.

- By managing my own escrow, I'm also able to pay for homeowners insurance with a credit card and get reward points.

Ready to start managing your own escrow account?

And research insurance costs 1-2 months before policy renews?

Leave a Reply