Statute of limitations is used to define a period of limitation for bringing certain types of legal action. For example, when you buy a new house, the builder is liable for problems for a limited period of time. Once this period of limitation is exceeded, a home buyer can no longer file a claim against the builder.

The statute of limitations is meant to encourage the resolution of legal claims within a reasonable amount of time. However, the statute of limitations varies by state, and is different for criminal and civil cases. So when I received a phone call from an attorney regarding a real estate transaction I was involved in close to 18 years ago, I was completely taken aback.

When the caller started asking me details about a piece of wood used in the construction of an addition that was made by my seller, I was dumbstruck. I could not answer his questions.

My response as a realtor was “Isn't there a statute of limitations that protects me and my seller?”

Statute of Limitations for Property Disclosures

The closing had occurred more than 10 years ago and I represented the seller, Eric. Whenever I give my sellers the real estate disclosures to fill out, I insist that they do them on their own and never leave anything out. I explain that no matter how small a detail may seem, they are required to include everything they know about the property.

Technically this is the seller's disclosure so their real estate agent should not fill out these documents.

Eric had lived in the home for over twenty years. It was dated when I first looked at the house to give him an estimated value. As instructed, he removed all of the gold and maroon wallpaper and had the interior painted real estate beige. The 70's green shag carpet was also replaced with basic beige carpeting.

The house had stunning ocean views which was the property's saving grace. With three bedrooms and two baths, it did not have a master suite and only had a galley kitchen, with room for one person to cook. However, it had a great entertainment bar in the finished basement and a patio for entertaining that overlooked the ocean.

Flooding Issues Must Be Included in Property Disclosure

My memory has a statute of limitations in place too! I remembered all those details due to the number of open houses I held. But for the life of me, I could not recall anything about the basement ever flooding, or being refinished. I don't remember any conversation with Eric about the structure of the basement walls, water damage or drywall replacement.

Apparently, someone from the fire department had visited the new new buyer's house. They commented on how many times the property had flooded when Eric lived there. The fire department had been called on multiple occasions to help.

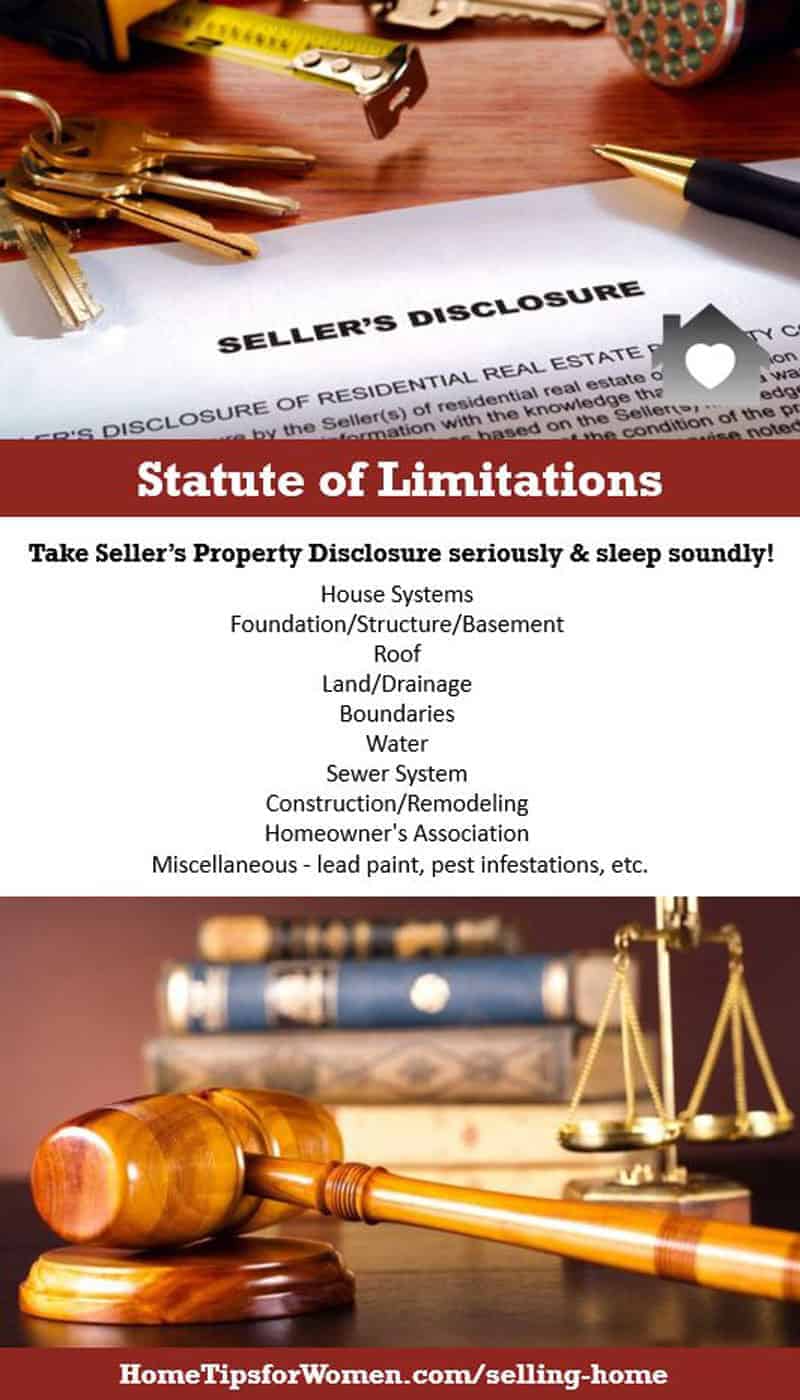

So what must a seller disclose to prospective buyers?

The seller's disclosure typically covers the condition of the property. Here is a summary of Kentucky's Seller's Disclosure of Property Condition.

- House Systems – any past or current problems affecting (n/a, yes, no or unknown):

- Plumbing

- Electrical system

- Appliances

- Floors and walls

- Doors and windows

- Ceiling and attic fans

- Security system

- Sump pump

- Chimneys, fireplaces, inserts

- Pool, hot tub, sauna

- Sprinkler system

- Heating, and the age of the heating system is requested.

- Cooling/air conditioning, and the age of the cooling system is requested.

- Water heater, and the age of the hot water heater is requested.

- Foundation/Structure/Basement – with 8 questions of which 5 questions are about water.

- Roof – with 6 questions focusing on leaks and repairs.

- Land/Drainage – with 4 questions covering soil stability, drainage and whether the home is located within a Special Flood Hazard Area requiring flood insurance.

- Boundaries – cover easements and whether the property has been surveyed for boundaries.

- Water – looks at the water supply and water quality.

- Sewer System – asks how sewage treatment is handled.

- Construction/Remodeling – asks about property improvements and permits to cover these.

- Homeowner's Association – reviews the cost of a homeowner association and what's covered by HOA fees.

- Miscellaneous – has 13 questions covering things like lead paint, asbestos, radon gas, pest infestations, etc. The most interesting one is about methamphetamine contamination.

Every state has different requirements for property sellers, along with different statutes of limitations. While the Kentucky property disclosure outlined above is more typical, here's what the state of Virginia requires in their residential property disclosure statement.

Virginia puts the burden on the property buyer to “use due diligence” to research and identify any defects with the house they're buying. The wording is pretty clear, stating that “The owner(s) of the residential real property makes no representations (or warranties) …

- As to the condition of the home”. Instead they advise buyers to obtain a home inspection.

- With respect to parcels adjacent to the subject parcel, including zoning classification or permitted uses of adjacent parcels, purchasers are advised to exercise due diligence.

- Whether provisions of any historic district ordinance affect the property, purchasers are advised to exercise due diligence.

- Whether the property contains any resource protection areas established in an ordinance implementing the Chesapeake Bay Preservation Act, so buyers are advised to exercise … you guessed it, due diligence/

- With respect to information on any registered sexual offenders, purchasers are advised to exercise due diligence.

- Whether the property is within a dam break inundation zone, buyers are advised to exercise due diligence.

- Presence of stormwater detention facilities or any maintenance agreement for such facilities …

- Presence of any wastewater system, including the type or size thereof or associated maintenance responsibilities …

- Right to install or use solar energy collection devices on the property …

- Property is located in one or more special flood hazard areas …

- Property has one or more conservation or other easements …

- Property is subject to a community development authority approved by a local governing body.

Who Was Protected by the Statute of Limitations?

When the call came, the house had been sold two more times after Eric sold this house. The attorney representing Eric's buyers were being sued as the sellers of the house. The problem came five years after the sale so they fell within the statute of limitations. However, Eric's transaction had occurred 16+ years prior. Even though he failed to disclose the basement flooding, he was protected by the statute of limitations. Because his buyers knew about the flooding (the firemen), they were liable for the non-disclosure.

The attorney tried to include Eric in the lawsuit because he didn't disclose the flooding in the first place. The statute of limitations was successfully used as a defense. Eric's sale fell outside the statute of limitations for California property disclosures or he would have been a party in this lawsuit.

The lesson learned? Disclose EVERYTHING

… so you don't need a statute of limitations defense!

I was sold a bad home in which the inspector missed defects such as: cracks in foundation & shoddy electric. I never received seller property disclosure which is required in KY, also the listing details which can still be seen on real estate sites, are false. This is my first time buying & owning a home. It was closed on Aug 2016. 3 out of 4 walls in my daughter’s room are starting to crack. The realtor has yet to respond to email & the inspector was someone she recommended. Apparently the listing agent knew of electricity in garage because she paid for someone to install manual means to open garage door that has electrical door opener installed to open it. The garage entry door was also to be replaced with solid core door which listing agent also paid for but the guy who did the work put a hollow interior door on it so it’s deteriorated badly. The home was supposedly like new & totally renovated due to electrical fire before I bought it. This is such a nightmare cuz I can not find out what, if anything can even be done about it. The repairs are costly & effect the value of it. I just want out from under this house & move to one that’ll not have such costly defects but fear that’s not possible. Funds for an attorney aren’t an option as I’m the sole caretaker of my special needs daughter & as a result, I’m unable to work. I’m desperately in need of some sort of resolution. So far no one has any to suggest.

Melissa, I’m sorry you’re stuck in this situation but I have to be honest and tell you that after 4 years, it will be hard to prove that the seller, realtor and home inspector are responsible … especially if you don’t have photos and/or written documentation supporting your claims. Here’s the story line I get from your description:

So what are your options? There aren’t any good options after 4 years … but here are ideas:

Wishing you luck working through this nightmare and yes, that’s exactly what it is … so find a friend who can help you with the emotions that you’ll have to deal with along with all the technical stuff.

I sold a house in 2009. The buyer put down 20,000 dollars and a promissary note to pay 10,000 over a period of 4 years, last day to pay being march of 2013. Payments were not made. The sale was in Louisiana. I have just found the paperwork and realized I was never paid the balance. the s.o.l. says 10 years. my question is when did the time of 10 years start

Lisa, First I have to tell you I’m not a lawyer although I’ve been in your shoes several times. Laws vary by state so all I can do is guess that the 10 yrs started on the day the promissory note was signed. You might try to file a claim through small claims court which doesn’t cost much … but I can promise you, hiring a lawyer to recover $10,000 is a waste of your time and money. It would likely take 1 to 2 yrs, the lawyer would settle for half the amount and take most of it to cover their fees … as I’ve not found the legal system in the US is primarily a lawyers playground (just look at what’s happening in Wash DC these days).

Property had underground fuel tanks that was not disclosed

Wow, I never thought about underground tanks on land supporting residential property but you’re right, it used to be common practice to bury oil tanks underground.

We bought a home exactly 4 years ago and were told there was no flooding evidence in the basement. Real estate agent never mentioned it, nor did the inspector. We have had horrible flooding that has gotten worse and in the last 2 years, all the neighbors mentioned our house used to have a river in the basement. Do we have any ability to go after selling agent or sellers themselves at this point? Also, we had to install a sump pump and drain system but how would we prove we had all this water? Our only proof now is mold on our drywall (new drywall we had installed before we knew it flooded). This is a second home so we are not living in it 100 percent of the time.

Kimberly, It will depend on the state where you live & a good real estate lawyer. First you need to jump on this quickly before the clock runs out. Most states require sellers to provide a property disclosure. If the sellers lied by omission, you should be able to pursue them … but I’m not a lawyer & haven’t had this experience myself. Good luck & maybe it’s time for me to write an article about basement finishing materials that can withstand flooding?

I purchased a home 5 years ago. I guy I bought from informed me incorrectly where the property line was. Years ago he built a pole barn without knowing where the property line was. Built it right on top of the line. Now we are fighting over who has the rights to this property. Survey matches my legal descriptions in the warranty deed and title. He is claiming mutual mistake, but I did agree to buy one of his 2 parcels. And this barn sits on the parcel I bought. Is there any statue of limitation on the sale of real estate?

Gayle, This is a tough situation and I’m not a lawyer. It’s also a good illustration of why a survey and title insurance are there to protect buyers … so I hope you used one/both of these. I recommend you grab a copy of

Nolo’s book, Neighbor Law: Fences, Boundaries & Noise. Their books are easy to understand and very comprehensive so I’m sure you’ll understand your rights & issues once you read it.

Nolo’s book, Neighbor Law: Fences, Boundaries & Noise. Their books are easy to understand and very comprehensive so I’m sure you’ll understand your rights & issues once you read it.

I sold a piece of property 17 years ago.I am now threatened with a law suit in the amount of $50,000 17 years later. $4,000.00 is to obtain a 15 foot strip of land taken by NYS back in the forties. This was communicated to the buyer and their attorney when purchasing the property. Amazingly, $46,000 to cover attorney fees because of legal disputes with other land owners. Does statute of limitations apply here?

This sounds like a very messy situation & you’ll need to talk to a lawyer who will have to research all the facts. I’m not an attorney so all I can suggest is that if the property was financed, there would have been a title search & title insurance that might cover this situation.