If you own a house, you've probably played with one of the many mortgage calculators. These calculators were provided by banks and other lending institutions involved in selling you a mortgage. Their purpose was to show you how much house you could afford. Sadly, traditional mortgage calculators only focus on costs to qualify for a mortgage, never looking at the true cost of home ownership which includes operating, maintenance and repair costs.

If you own a house, you've probably played with one of the many mortgage calculators. These calculators were provided by banks and other lending institutions involved in selling you a mortgage. Their purpose was to show you how much house you could afford. Sadly, traditional mortgage calculators only focus on costs to qualify for a mortgage, never looking at the true cost of home ownership which includes operating, maintenance and repair costs.

Now that housing is big news, the New York Times has developed a calculator that tells a more complete story. While their mortgage calculator focuses on helping prospective home buyers make the buy versus rent decision, it does a great job outlining the costs of home ownership and projecting a homeowner's return on their investment.

So here's a comparison of the numbers that go into your typical mortgage calculators, followed by the new calculator from the New York Times.

Costs Used in Traditional Mortgage Calculators

These are some (debt to income rations aren't included here) of the costs the banks look at when deciding how big a mortgage you qualify for.

These are some (debt to income rations aren't included here) of the costs the banks look at when deciding how big a mortgage you qualify for.

- Home price is a better term to use when describing the price you expect to pay for a new house, which must be supported by an appraisal (the value).

- Down payment indicates how much money you plan to put down when purchasing a house (and subtracted from the house price, represents the loan amount).

- Length of the mortgage or “loan term” indicates how long a payback period you want for your loan, with 30 years being pretty standard.

- Mortgage rates are quoted in round numbers like 4%, 4.25% or 4 and 3/8ths percent. The effective APR (annual percentage rate) is a standardized way to describe interest rates. The APR should be used to compare lenders and loan products … and they're always funny numbers like 4.34 percent.

- Property taxes and house insurance (missing in calculator at right, so I include with the property taxes) .

- PMI (private mortgage insurance) is required for loans where the down payment is less than 20 percent. This insurance will be purchased from the government if you're getting an FHA or VA mortgage.

Note: This is the calculator I use, from MortgageCalculator.org, because you don't have to answer any annoying questions to get access to the calculator. For anyone using the calculator, you should understand that it's intent is to drive leads (when you click) to the advertisers on the page, and I cannot vouch for any of them.

Costs Included in the Buy vs Rent Calculator

So let's move ahead to what is now one of my favorite mortgage calculators (NY Times.com) because it helps prospective home buyers understand the true cost of home ownership. This calculator looks at all homeowner costs, from the initial purchase to recurring operating costs and finally, the net proceeds after you sell the house.

So let's move ahead to what is now one of my favorite mortgage calculators (NY Times.com) because it helps prospective home buyers understand the true cost of home ownership. This calculator looks at all homeowner costs, from the initial purchase to recurring operating costs and finally, the net proceeds after you sell the house.

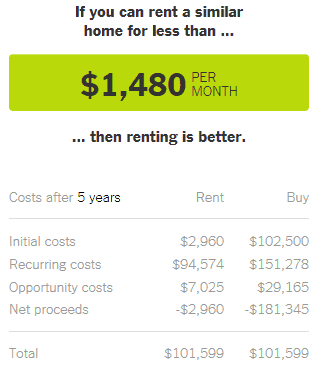

The example at right, compares initial costs (down payment and closing costs) versus a renter's security deposit. Recurring costs include all homeowner costs versus rent. And the real test is the “net proceeds” when a house is sold versus getting your security deposit back. The NYTimes calculator gathers the homeowner data and calculates the break even rent. For this example, if you can rent the equivalent house for under $1,500, then renting is a better option. But in fact, rents where this house is located start around $2,000 a month.

There are 21 items you have to project compared to 6 (plus closing date) above, but it's well worth the time invested.

- (1) Home price and (2) how long you expect to stay in the house, which defines how many years the upfront fees can be spread across.

- Mortgage details – (3) cover mortgage rate, (4) down payment and (5) the length of the mortgage.

- Projecting the future – which includes

- For buyers – (6) your projected home price growth rate and (7) investment return rate.

- For renters – are vulnerable to the (8) rent growth rate.

- For both – (9) they're affected by the inflation rate.

- Taxes include – (10) property taxes and (11) your marginal tax rate.

- Closing costs – (12) both buying costs and (13) homeowner selling costs.

- Or renter costs – (14) security deposit, (15) broker's fee and (16) renter's insurance.

- Maintenance and fees – (17) maintenance and renovations, (18) homeowner's insurance, (19) monthly utilities, (20) monthly common fees less (21) deductible common fees.

So you can see how different these mortgage calculators are. It's not as easy as completing the traditional calculator but you'll get a much better picture of the true costs involved in owning a home, and how they interact with each other. Don't assume the formulas behind the calculator are flawless because there are too many variables. For example, we're moving from New Hampshire that has high property taxes but no state income tax. In Arizona the property taxes are much lower than NH, but there's state income tax which negates these savings.

You don't need to put in exact numbers. You simply move the slider left or right to reflect your best cost estimates and watch what happens to the other calculations.

Leave a Reply