Finding the perfect house is exciting. It's also necessary because you need something to motivate you as you slog through the paperwork maze. And that's from someone buying their 14th house, so it should be easy … but it's not. The house buying process is simply reacting to the housing meltdown, so it's more complicated as lenders go crazy collecting more information than makes sense but we have to play the game.

What's missing is an end-to-end roadmap to help you get through the house buying process. You get lots of paperwork from your real estate agent, from the mortgage company, the title company, the people doing home inspections, moving companies, painters so your house is ready to move into. Each home professional focuses on their piece of the puzzle. There's no one providing a complete checklist of all the paperwork a home buyer can expect, and the order in which it has to be handled.

So this article introduces all my paperwork I started to collect once we completed negotiations with the seller. In a future article, I'll share how I organized all the paperwork in Dropbox, including file naming conventions to make it easy to find everything.

And by now you might realize there's a lot more paperwork involved, with more than 80 documents in DropBox … and that doesn't include all the real estate forms signed and stored in my real estate agent's DropBox folder.

Note: The Arizona Association of Realtors® has created an incredible set of documents, and knowing how much work was put in to develop these documents made me more comfortable reviewing and signing them.

House Buying Starts with a Purchase Contract

- Pre-Qualification Form from our mortgage broker, was attached to the purchase offer we made to document where we were in the loan application process.

What Happens with a Credit Report

Once the loan application process starts, you should expect to receive a Consumer Explanation Letter from the mortgage broker. It will ask you to explain in writing, any non-standard items that showed up on your credit report.

Late payment on a second credit card my husband got … but the last time this happened was almost 4 years ago?

Late payment on a second credit card my husband got … but the last time this happened was almost 4 years ago?- Conflicts between stated home addresses and 2 other houses we owned, along with my business address. What was strange was the dates listed didn't match dates when we owned the houses. For example, someone is reporting us living at an address through November, 2009 … when we sold the house in March 2006?

- One line for each credit reporting bureau, for when the mortgage company pulled our credit report. If computers are smart enough to list these, they're also smart enough to merge and/or pre-fill a response!

- One of my husband's relatives (I think) showed up on our report and required an explanation.

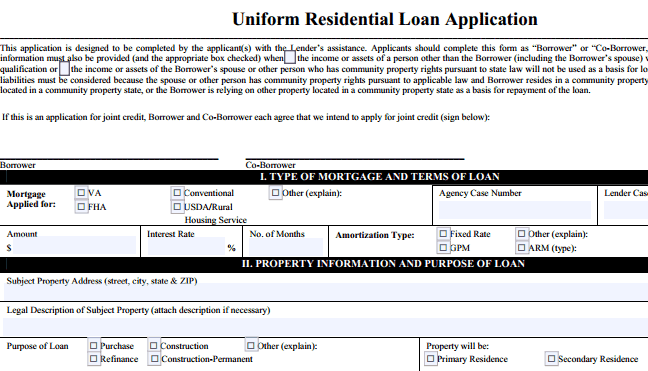

List of Items Needed for the Loan Application

You should get a list of documents needed to support your loan application. To make sure you truly understand what's being asked for, it is best to review both your application and this list, with your loan officer. That's because the terminology used won't always be familiar to you. For example, the list I received asked for 1099s which I associate with sub-contract work, e.g. when you're not an employee. It turned out that pension payments for year end taxes, are documented using 1099s.

- Last two months of bank statements (all pages, all accounts).

- Last two months of retirement and 401K statements (all pages, all accounts).

- Last 30 days of pay stubs or current LES (military).

- Award Letters for Retirement Income, Social Security, Disability Income and SSI (if applicable).

- Last 2 years of 1040 Federal Income Tax Returns.

- Last 2 years of Federal Corporate and/or Partnership Tax Returns (self-employed).

- Last 2 years of W-2 Forms.

- Copy of driver’s license and Military ID (military).

- Statement of Service from Command — must include eligibility for reenlistment.

- … and oops, as I'm filing the paperwork, found more items in the email that weren't included with the list above

- Current mortgage statement.

- Current home's tax bill.

- Current home's insurance binder (this was confusing, current or new house, in list received).

- Year to date, profit and loss statement if you own your own business.

Crazy Documents Found with Every Closing

- Arizona Authorization to Complete Blank Spaces – OMG, you have to give permission for the mortgage company to fill in spaces after you've signed a document.

Late payment on a second credit card my husband got … but the last time this happened was almost 4 years ago?

Late payment on a second credit card my husband got … but the last time this happened was almost 4 years ago?

Leave a Reply