Last week I learned how important it is to trust my instincts. I agreed to a 30 day closing on our new house and quickly regretted this because there were problems with my mortgage company from the start. After several weeks, I finally moved my loan to another company just a week before the scheduled closing. This was a tough learning experience but I learned from this home management mistake.

Last week I learned how important it is to trust my instincts. I agreed to a 30 day closing on our new house and quickly regretted this because there were problems with my mortgage company from the start. After several weeks, I finally moved my loan to another company just a week before the scheduled closing. This was a tough learning experience but I learned from this home management mistake.

I learned you should take charge at the beginning and home management starts with the buying process!

This should have been easy, as it's the fourteenth house we're buying. We thought our challenge was finding a location with little to no light pollution, and a backyard flat enough to build an observatory. Now I realize things would have gone smoother if I'd actively managed the mortgage process versus waiting to be asked for documentation.

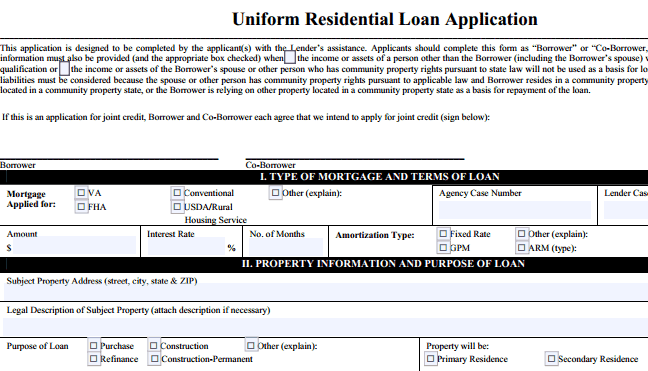

What I also didn't consider was managing a long distance closing, working with a new and untested loan officer and the new rules which the government has imposed on lenders since the housing meltdown. Oh, and I guess I should add that all of the companies involved have gone to electronic documents, e-Signing and more. Some companies have implemented good software like the Arizona Association of Realtor's eSign, and you'll recognize the same paper forms delivered electronically versus true digital apps.

So while everything is fresh in my mind, let me share my lessons learned and it's not just about buying a house. It's really about stepping into my role as the Chief Home Officer for my family. It's about playing a more proactive role in managing all aspects of home ownership, what I call home management!

Home Management Mistake #1 – Letting Others Set the Schedule

Our lives are pretty busy. Adding an unplanned home purchase into the mix should only be done after carefully reviewing your schedule. Assuming this closing would go as smoothly as prior ones, I agreed to a 30 day closing.

Lesson Learned – Look at your calendar before you commit to making a new project your top priority. Knowing that launching my new website was my top priority, should have told me I'd need at least 60 days to close.

Lesson Learned – Evaluate your team's ability to meet your schedule, or even better, include real estate professionals on your homeowner team so you're working with people you already know and trust.

With my only other 30 day close, I went with Wells Fargo because they'd financed the condo next door. When they falsified my application and told me I couldn't close on schedule, I went back to my old mortgage broker. He took me from commitment to closing in 7 calendar days … but alas, that was in 2006 before the housing crisis added a few more hurdles to the process.

Home Management Mistake #2 – Not Making Sure Mistakes are Fixed Quickly

When I think back to many of former my closings, I realize I was very passive. After completing the loan application, all I did is provide the documentation requested without understanding how it was used by the lender … but realized I could have been more proactive to find and resolve problems sooner.

Lesson Learned – When providing input verbally or via electronic application, always get a copy to review and make sure errors are corrected right away. The closer you get to the actual closing, the harder it is to get things corrected … and just because you point out problems via email, doesn't mean mistakes in legal documents are fixed.

Lesson Learned – Allow enough time to read (at least skim) documents you're asked to sign, and don't sign anything you don't agree with. When asked to sign off on the Good Faith Estimate (GFE, explained in this HUD document) and loan application with numbers that didn't match, I first refused … and then signed, but indicted I didn't agree with the numbers.

Home Management Mistake #3 – Not Creating a Document Checklist

Honestly I was being naive thinking the mortgage process couldn't have changed that much, but it has. Lots of documentation is required and while your lender might give you what looks to be a complete list, you should make time to really understand what's being asked for.

Lesson Learned – Don't assume you have a complete list. Rewrite the list in your own words and review with your loan officer to make sure it's complete. To me, 1099s are like W-2s but for sub-contractors. Surprisingly, 1099s are also used to document pension income for year end taxes, … and figuring this out at 11:30pm a week before closing, wasn't fun.

Lesson Learned – Make sure you understand the big picture and how the puzzle pieces (documentation) go together. For example, monthly pay and pension documents need to match 1040 taxes so don't leave anything out, because you'll be chasing it down later.

Life is a journey and what's important is learning from your mistakes. By sharing even one home management mistake that you can use, I hope your home buying process goes more smoothly.

Leave a Reply