There are multiple ways that mortgage interest rates can be described. The annual percentage rate of change or APR is the standard used to compare lenders and loan products. In fact lenders in most countries are required to disclose borrowing costs using a standard rate like the APR.

There are multiple ways that mortgage interest rates can be described. The annual percentage rate of change or APR is the standard used to compare lenders and loan products. In fact lenders in most countries are required to disclose borrowing costs using a standard rate like the APR.

There are two types of APRs used when discussing mortgage loans.

- The nominal APR is the simple interest rate for a year. It's what is typically advertised at 4 percent, 4 1/4 percent or 4 3/8ths percent (often written as 4.375).

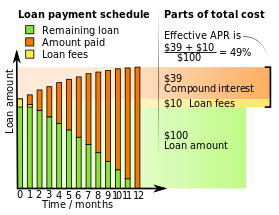

- The effective APR is the loan origination fee + compound interest rate, annualized for an entire year versus a monthly fee/rate.

Calculating the effective APR is still very confusing as there are several different ways to compute the value. To dig deeper, you can look at the detailed information on Wikipedia for calculating the annual percentage rate. Their simple illustration shown here, is for a $100 loan to be repaid over 1 year … with a loan fee of $10.